Simonson Appraisals had a unique opportunity to do a deep dive in 2020 to develop an understanding of the impact of multiple factors affecting the Minneapolis apartment market. Our firm appraised a portfolio of apartment buildings in the Loring Park neighborhood in March 2020 two weeks after COVID-19 was announced as a global health pandemic. We provided additional services six months later in October 2020. There were several key distinctions drawn from our research that depict these market changes and how landlords are adjusting to changing market conditions.

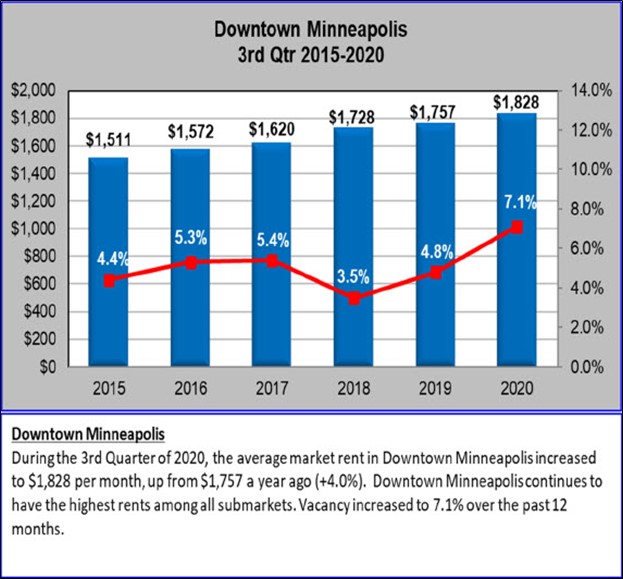

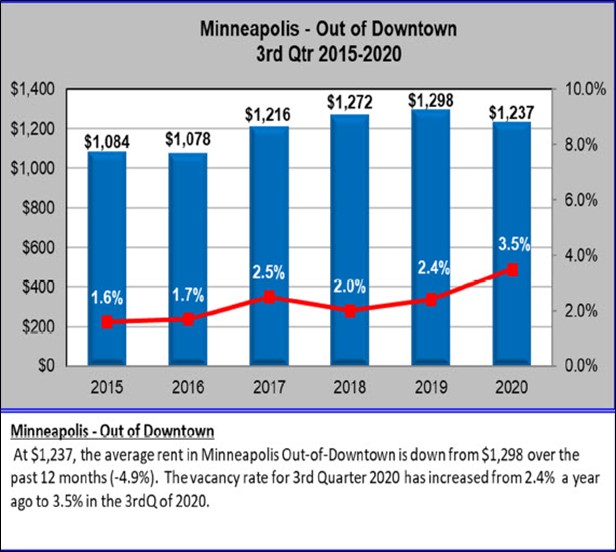

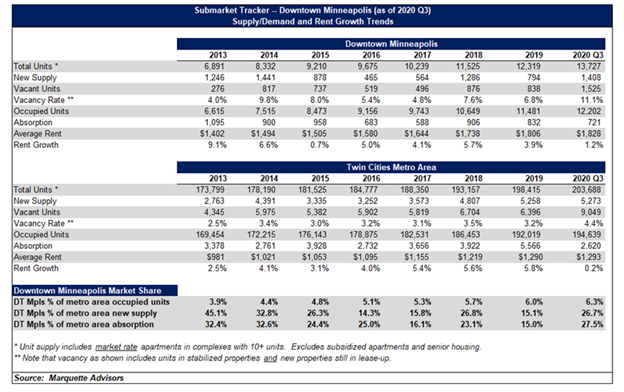

We first present a few charts, graphs, and statistics with data provided by Marquette Advisors. Note this data is from 3rd Quarter 2020.

The table below is from Marquette Advisors and offers detailed information as of 3rd Quarter 2020 for Downtown Minneapolis.

Vacancy in Downtown Minneapolis increased from 6.8% to 11.1% from 2019 to 3rd Quarter 2020, including new properties still in the lease-up phase. Rent growth, which had previously been steadily rising in the range of 3.9% to 5.7% annually from 2016 to 2019 slowed to a positive 1.2% in 2020.

The previous charts, graphs, and statistics reflect a steadily improving market and submarket over a long period of time. Rents have increased over several years to the point where developers are building new product. Vacancy rates have been at an all-time low for several years. Absorption was quick with new product, and new product rents have pulled Class B and C rents upward.

As noted, COVID-19 was recognized as a global pandemic on March 11, 2020. Subsequent to that local, regional, state, and national lock-downs ensued and with that came an economic and employment change. During that time there were mixed reports about multifamily rent, vacancy, and collection figures from various sources. Minnesota enacted an eviction moratorium, restricting landlords from evicting delinquent tenants. People received economic stimulus money and many unemployment benefits were quickly greatly expanded.

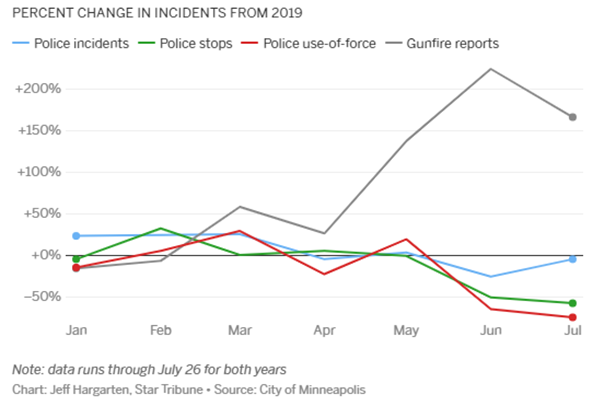

At a parallel time, a man was killed while in police custody on May 25, 2020 in Minneapolis. This led to several rounds of protest, violence, and property destruction nationwide, with the epicenter being Minneapolis. Curfews were put in place, the National Guard was called in, and a push came from the Minneapolis City Council to defund the Minneapolis Police Department. Due to a variety of reasons, the police force has been depleted (it is still intact at present time) in its number of officers and ability to respond.

These two major issues happened simultaneously, and the effects have been blended together, specifically in Minneapolis. There are many opinions in the market. We went straight to the source and conducted interviews of actual owners, buyers, sellers, managers, and brokers that are active in the current market to get statistics to apply in our analysis. In addition, this report provides up-to-date statistics on multifamily activity, crime, and policing in Minneapolis.

We had a conversation with one multifamily property owner in the Loring Park neighborhood that owns more than 1,000 apartment units. As of March 2020, their portfolio had a 2% vacancy overall. As of October 2020, that portfolio had increased to 9% physical vacancy. They cited there has not been a rise in rent collection or delinquency and the eviction moratorium has not significantly impacted their business. Of the 7% change, their opinion is that roughly 5% of that change is from civil unrest and crime. The other 2% would be COVID-19 related including all economics surrounding it. This information is from exit interviews of all tenants that vacated their properties during that seven-month time.

In addition to physical vacancy, that landlord is now offering concessions of one month of free rent with a 12-month lease, or an 8% discount on rent. In addition to vacancy, they stated new tenant inquiries have significantly slowed. This owner also has over 200 multifamily units in St. Paul and they stated the vacancy rate on that portfolio is at 2%. This information in addition to their conversations with many other owners in suburban Twin Cities locations indicated to the owner that the vacancy change is a Minneapolis-specific issue and not a metro apartment issue. The owner opined that the civil unrest in Minneapolis is a larger contributor to the vacancy change than economic factors.

A final factor stated was that many businesses are now allowing employees to work from home into the foreseeable future. Employers and employees were forced to quickly adapt when stay-at home orders were put in place, but their future plans include many work-from-home options. This allows employees to potentially live farther from their workplaces, many of which are in Downtown Minneapolis.

This same owner is also an active buyer in the market and has been for quite some time. Their thoughts were that the sale transaction market has not yet caught up to the income declines and that sale prices generally have not changed. There is always a lag in pricing if there are changes to the economics of a property type. In addition, they thought some participants saw these declines as short term and were purchasing speculatively.

One active multifamily broker supported many of the same thoughts. He stated changes on the leasing side including the addition of concessions as well as increases in physical vacancy in the Minneapolis and Downtown Minneapolis market. Rents have remained steady, which is a change from previous years where increases would be prevalent. He cited civil unrest several times and said buyers and sellers are seeing that as a larger issue compared to COVID-19.

Some buyers have pulled out of deals because of it and some are even reversing course and turning into sellers, moving their entire portfolios and investment interest to the suburbs. This, of course, creates other buyers and owners to take their place. Generally speaking, these new buyers are younger and have been more aggressive and have been waiting on opportunities to own in urban areas. Sale prices for well-located properties haven’t changed much as people are still in a “wait-and-see” environment.

A second multi-family broker offered comments on properties for sale and spoke about how in the past they may see 10-15 offers and now they are seeing closer to five legitimate offers. Still, the offers coming in are strong and supported. Buyers have adjusted and are looking at trailing 12, 6, and 3-month figures instead of just looking at longer history to see what type of short-term impacts have been made. He mentioned that buyers are also projecting flat rents as opposed to projecting rent growth. This is a major change compared to the past few years.

A separate apartment portfolio of 200+units across multiple buildings in the Loring Park neighborhood saw vacancy rates increase from 1.9% to 4.2% between March and October 2020. In addition, ownership and management indicated new potential tenant leads have dried up. Phone calls and email inquiries have significantly slowed.

Looking deeper into claims of rising crime, several pieces of information are included from the City of Minneapolis website. Around 100 officers in the Minneapolis Police force have left the department or taken leave since the beginning of 2020 and the force has shrunk by 130 since this time last year. Arson is up 55% over 2019 and more people were killed in the first nine months of 2020 than all of 2019. Violent crimes, defined as homicide, rape, robbery, and aggravated assault, are up 17% from the previous five-year average. So, while crime is increasing the police force is declining. The chart below illustrates a sharp rise in gunfire and a decline in police stops.

Conclusion

The Twin Cities multifamily market has seen growth and positive movement in almost every category for at least 10 years. New developments filled quickly and rents in new developments continued to increase. As a result, rents at existing and “older” properties were also driven up. This has been especially true in Minneapolis. Vacancy in Minneapolis experienced record lows for multiple years. During the early uncertainty of COVID-19, landlords reported little to no change in vacancy. With time, the health pandemic mixed with crime and civil unrest have weakened segments of the economy and created a change in multifamily income economics. For the most part, participants noted that there has not been a large change in sale prices, however income statistics indicate declines in rental income and increases in vacancy.

About the Author

Mitchell Simonson, Founder, Simonson Appraisals

With a wide range of commercial appraisal experience and real estate consulting, Mitchell Simonson’s 17 years of experience, knowledge, and ‘boots on the ground’ attitude are invaluable assets that have helped countless clients make smart business decisions. As owner and founder of Simonson Appraisals, he leads the firm in delivering credible valuation services for financial institutions and attorneys specializing in the areas of condemnation, property tax appeal and estate planning.

Tell us – how has COVID-19 affected your business? What is your best plan or forecast to return to pre-COVID levels? If you have any questions or would like to discuss the topics covered in this article, please contact us today!