As the impact of COVID continues to unfold and the real estate market grapples with rapidly changing information and market conditions – commercial appraisers have had to quickly adapt to a new way of gathering reliable and credible data to base their appraisal analysis from.

At Simonson Appraisals, we have found great importance in real-time property-specific conversations to keep the available data ‘fresh’ and accurate. Whether this means developing a COVID Market Condition Analysis Tool in collaboration with our National Bank clients, participating in multiple CRE, or cultivating consistent communication with our clients and market participants – we’ve adopted a ‘forge ahead’ mentality to provide you, our client, an accurate valuation regardless of market conditions.

COVID-19 Market Analysis – Insights and Impact Analysis

Key Language in Letter of Transmittal

Every appraisal needs to introduce COVID-19 in the Letter of Transmittal. The client should be clear that the assessment is performed at a point in time and that the market value opinion is – as of a specific date – the effective date.

Regional Analysis is Relevant

Since COVID, one key area that takes on heightened importance is our regional and local market analysis section’s current environment. In a regular market, say pre-March, our regional and local market section has less relevance. When the market’s just chugging along with no significant disruptions, you can update the report’s rational analysis, which talks about demographic trends, major employers, employment trends, because they don’t change a whole lot. But since March, these sections of our appraisal reports require weekly, sometimes daily revisions to help provide a current perspective of how the local regions have been impacted. Key areas we’re tracking include unemployment data, the impact of significantly reduced restaurant service, and entertainment options – which ties into the effect on specific property types and occupancy.

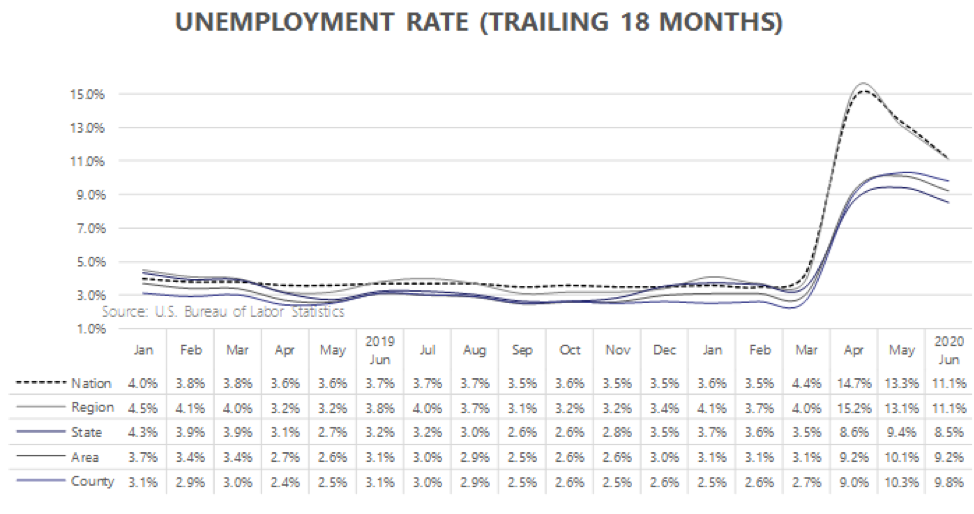

Here’s a current unemployment chart over the last 18 months, showing both the national down to the Minneapolis, St. Paul, MSA, and Hennepin County. One positive is while we’ve seen a massive spike in unemployment, the Twin Cities Metro is performing at a level below the national average. This comes down to our diversified economy in the Twin Cities being our biggest strength.

What’s Hot & What’s Not

Here is a quick break down of what’s hot in the commercial real estate market and what’s not:

- Industrial is performing the best (lowest delinquency rate) in large part because of e-commerce.

- Multi-Family rent collections are holding steady as of now, with a few potential clouds in the coming months.

- Retail is a tale of the haves and have-nots.

- Office: Mpls CBD is reportedly seeing 10-15% occupancy. When companies decide to return and future space needs are important factors.

- Hotel: CBD locations are hurting the most.

- The key factors for all sectors right now are location and use.

Transactions Trending

Q1-Q2 Comparison of overall commercial sales in Twin Cities 11-County metro and select sectors:

Q1: 504 properties sold w/total value of $1.718 billion

Q2: 229 properties (-55%) sold w/total value of $943 million (-45%)

- Industrial sales transactions down 14%, total value up 197% – CSM portfolio

- Multi-Family transactions down 65% with total value down 90%

- Office transactions down 55% with total value down 80%

- Retail sales transactions down 74% total value down 89%

- Hotel transactions went from 8 to 0 sales

(Source: REDIComps)

Breakdown of Impact by Sectors

Industrial: on the industrial side, the CSM portfolio, $650 million (involving about 40 properties) closed from the end of the first quarter to the second quarter. This pushed the total value of industrial transactions up 197% in the second quarter. The second-quarter transaction volume was only down 14%. Most industrial brokers and buyers continue to be in strong demand for a lot of our market research. Buying patterns are changing and we’re starting to see the overall change with e-commerce and more people buying from home. The industrial sector has performed well in terms of performance.

Retail: This sector is a tale of the haves and have-nots. Essential retailers are performing well and demand has even increased for certain retail uses. One example is Dollar General. We’ve done several appraisals in Minnesota of new construction Dollar General stores since the March timeframe and cap rates have compressed. Sit-down restaurants with large footprints have struggled while fast food has thrived, especially locations with drive-thru capability. In addition grocery stores and grocery-anchored centers have continued to be at the top of the retail heap with more people at home, cooking, and eating out less.

Multi-Family: It seems like most rent collections are continuing to show favorable and steady rates on the multi-family side, but transactions are certainly down. If you look at the second quarter, they were down 65%, but the total value is down about 90%, meaning the sales that are occurring are smaller in the current market.

Office: In this sector both transactions and values are down based on data year to date.

Cap Rates to Consider

Let’s break down the industry cap rates to get a better look at how the commercial market is trending:

Industrial

- Distribution Centers – 5.0%, Amazon deal – upper 4s

- High quality, new industrial investment-grade – 6.0%-6.75%

- Good quality, smaller owner/user buildings in Minneapolis/St. Paul – 7.0% – 8.0%, getting to the fringe and beyond, cap rates exceed 8% and upwards of 9.0%.

Multi-Family

- Urban core Class A – range of 4.5% to 5.0%

- Suburban Class A – 5.0% to 5.5%

- Class B – 5.5% to 6.25%

- Class C – 5.75% to 6.75%

Retail

- Strong credit, triple net leases – 5.0% to 6.5%

- Moderate credit tenants – 6.5% to 7.5%

- Multi-tenant retail centers – 6.0% to 8.0%, pre-COVID. Now, it depends.

- Class C properties/greater MN – wide cap rate range and can approach 10% or higher.

Greater Minnesota Apartments

- More metro buyers in markets outside the Twin Cities.

- Higher quality apartments in the larger communities (Fargo, Mankato, St. Cloud, etc.) – 6.0% to 7.00%.

- Cap rates for average-to-good quality properties in smaller communities generally range from about 6.5% to 7.75%.

What are Banks Lending On?

After looking at how the numbers break down, it begs the question: What are banks lending on in this uncertain and unpredictable market? The larger national bank lenders confirmed they are still active in new construction lending and successfully close several pre-construction loans that were in process when COVID-19 started. But now, as COIVD has been drawn out, a more conservative approach is being taken. In-depth underwriting is currently taking place to ensure the borrowers and tenants occupying space have the durability to continue performing no matter what conditions the market presents. While the massive amount of government stimulus helped initially buoy the economy, the question exists on the longer-term impact as the stimulus starts to run out. This causes most lenders to have lowered loan-to-value ratios and installed interest rate floors to offset the higher risk due to the current market environment.

Outlook for the Minnesota Banking Industry

The outlook for Minnesota looks promising. Some banks see opportunities to gain market share as they opened PPP loans to non-bank customers at the onset of COVID. This may translate into future growth. When you look at how Minneapolis, Saint Paul compares to the rest of the country, one of our biggest strengths is the diversified economy that our area has. Several large Fortune 500 companies and others have been instrumental in providing different products and resources for COVID recovery. As a result, you tend to see smaller peaks and valleys in our economy compared to some of these coastal markets. I found it interesting that most of the banks we talked with spoke about having lower volumes of past-due loans. There’s been some loan payment deferment or change to interest-only, but there is caution with the potential for increase in past due loans to rise.

Bottom Line

While it’s challenging to predict and analyze the impact COVID will have on the commercial real estate market, appraisers can only continue to provide boots-on-the-ground research and analysis, and continue to change as the market changes.

Tell us – how has COVID-19 affected your business? What is your best plan or forecast to return to pre-COVID levels? If you have any questions or would like to discuss the topics covered in this article, please contact us today!

This could well be, however, the silver lining of the cloud. Over half of renters have at-risk wages because of the pandemic and live in single family or small multi-family rentals with two to four units. It is likely that federal relief has been propping up the rental payment numbers. The $600 weekly federal enhancement to unemployment benefits will end on July 31, unless Congress acts to extend it or provides some other form of rent relief payments. One indication of buyer expectations becoming increasingly cautious in the multi-family market is that one commercial real estate broker has reported eight multifamily deals that have been sidelined recently.