On March 11, 2020, the World Health Organization announced COVID-19 as a global pandemic (this day also happens to be my birthday so good or bad, it’s an easy date for me to remember). Since then, market uncertainty has caused commercial investors to increasingly worry whether their commercial appraisal analyses are accurate.

At Simonson Appraisals, our team works tirelessly to ensure those worries are needless. We do so by attending commercial real estate events to gain insight and stay up-to-date on the current market trends. This allows us to continue to deliver well-reasoned and credible appraisal reports. Our adaptive, hassle-free and convenient appraisal process will provide you with the confidence to make the right business decision for your needs, no matter what the market is doing.

On August 14, 2020, the Minnesota Real Estate Journal held the 13th Annual Capital Markets Summit at the Radisson Blue Mall of America Hotel. It was here that I had the opportunity to moderate the Banking and Construction Lending Update discussion with Patricia Gnetz of U.S. Bank, John Rent of Wells Fargo and Scott Swenson of Drake Bank. We had a great discussion! I learned much about the evolving views and changes banks are formulating due to COVID and Minnesota’s outlook for the remainder of 2020. The primary discussion topics were:

- Profile of deals that are getting closed and how banks’ view of commercial real estate property types has evolved

- Update on borrower requirements and Interest Rate Trends

- Outlook for the Minnesota banking industry and how it compares to the rest of the country

What is the profile of CRE deals that are getting closed?

Based on lender interviews and market reports, appetite for lending on each of the property types generally falls into in the following ranking (in order of best to worst).

- Industrial

- Multi-Family

- Office – depends on location and tenant mix

- Retail – Dependent on tenant mix

- Hotels – While there are some lending options, most of the banks surveyed talked about steering clear of hotels at present time.

Diving deeper into the property types, we discussed the particular importance of location right now. In a normal market, central business district markets are generally viewed as most desirable and extends out from there. With civil unrest concerns, occupancy restrictions and changing travel patterns, some property types are seeing demand reverse. With more office workers working from home, this greatly impacts day population counts, which then directly affects retail and hotels in the core urban areas.

A consistent theme shared is that most deals being completed in the current environment are stable properties that must fit the parameters of the bank lending terms. Owner occupied properties, strong credit build-to-suit and essential businesses are in favor. A more conservative approach is being taken and in-depth underwriting is taking place to ensure the borrowers and tenants occupying space have the durability to continue performing. The larger national bank lenders confirmed they are still active in new construction lending and were able to successfully close several pre-construction loans that were in process when COVID-19 started.

A few questions often being asked of each borrower today include:

How has COVID-19 affected your business?

What is your best plan or forecast to return to pre-COVID levels?

Update on Borrower Requirements and Interest Rate Trends

Since COVID, most lenders have lowered loan-to value ratios. Other impacts include greater borrower recourse, and several have installed interest rate floors to help offset higher risk in the current environment. The majority of lenders predict interest rates to remain low over the next six to 12 months. The massive amount of government stimulus is helping buoy the economy. As some of the stimulus starts to run out, questions exist on the longer-term impact.

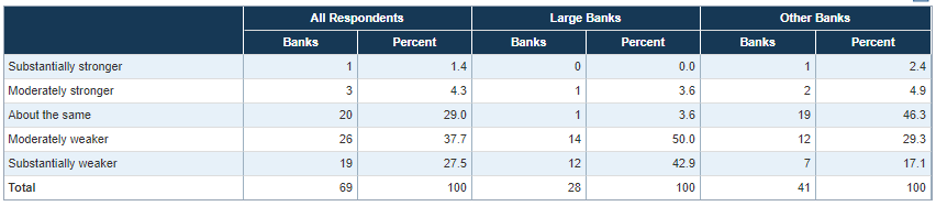

According to the Federal Reserve July 2020 Senior Loan Officer Opinion Survey on Bank Lending Practices, “Major net shares of domestic banks tightened standards on all three CRE loan categories over the second quarter. Meanwhile, major net shares of domestic banks reported weaker demand for all three CRE loan categories during this period. Similarly, major net shares of foreign banks tightened standards on CRE loans and reported weaker demand for such loans.”

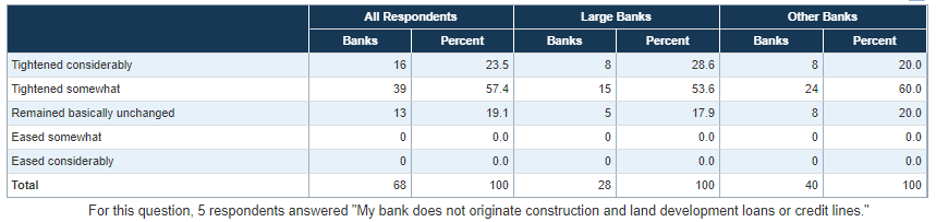

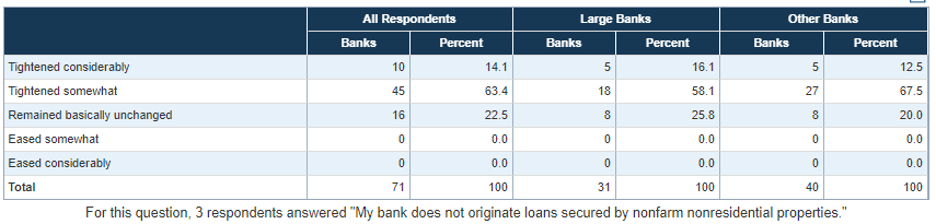

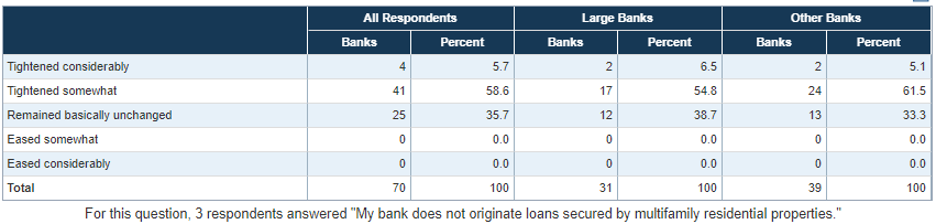

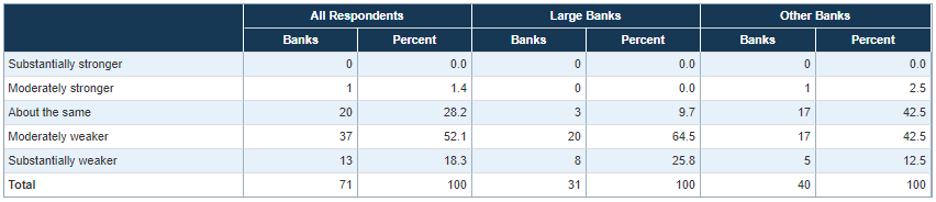

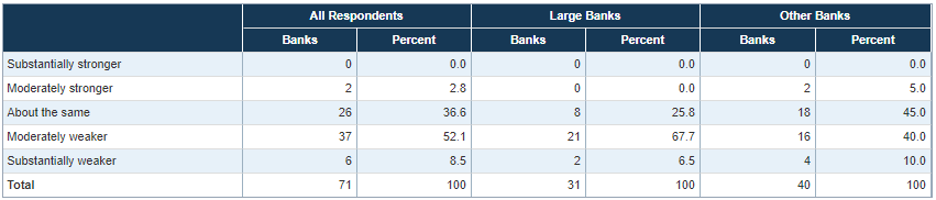

As part of the July 2020 Federal Reserve survey, the following six questions ask about changes in standards and demand over the past three months for three different types of commercial real estate (CRE) loans: construction and land development loans, loans secured by nonfarm nonresidential properties, and loans secured by multifamily residential properties.

- Over the past three months, how have your bank’s credit standards for approving new applications for construction and land development loans or credit lines changed?

2. Over the past three months, how have your bank’s credit standards for approving new applications for loans secured by nonfarm nonresidential properties changed?

3. Over the past three months, how have your bank’s credit standards for approving new applications for loans secured by multifamily residential properties changed?

4. Apart from normal seasonal variation, how has demand for construction and land development loanschanged over the past three months?

5. Apart from normal seasonal variation, how has demand for loans secured by nonfarm nonresidential properties changed over the past three months?

6. Apart from normal seasonal variation, how has demand for loans secured by multifamily residential properties changed over the past three months?

Outlook for the Minnesota banking industry and how it compares to the rest of the country

Banks are more conservative in their current lending approach and tend to be internally focused at present time. Having said that, some banks see opportunities to gain market share as they opened up PPP loans to non-bank customers at the onset of COVID. This may translate into future growth.

When asked how CRE lending compares to the rest of the country, the strength of the diversified economy in Minneapolis/St. Paul will bring stability to the market. Several local companies in the medical technology industry such as Medtronic, 3M, Ecolab, United Health Group have been instrumental in helping provide COVID supplies across the country and world. Others such as Target benefitted greatly as they were deemed an essential retail business. The concern is the downward pressure placed on so many small businesses that were not allowed to stay open initially.

One positive is the peaks and valleys experienced in our market are more moderate when compared to coastal or other larger markets across the United States. Most of the banks surveyed talked about having low volumes past due loans, with some expressing caution with potential of being in the calm before the storm.

Lastly, the national lenders discussed the increased collaboration in recent years with team members across the country as Minneapolis/St. Paul had gained stronger national and international investor interest. Some of this activity appears to have slowed at present time.

Mitch’s Mojo

Mitchell Simonson, MAI has been in commercial real estate for 16 years and founded Simonson Appraisals on January 1, 2019. Mr. Simonson enjoys writing about and discussing commercial real estate, personal development and business. Do you have questions on these topics? Contact him today!