Like the mighty Mississippi River that flows through the north edge of downtown Minneapolis, the Minneapolis/St. Paul commercial real estate market continues to move forward at a healthy pace with a few areas worth paying attention to.

Here are the best insights I gathered from the panel of speakers at the June 14, 2019 Commercial Real Estate Forecast Summit, put together by Jeff Johnson and the MN Real Estate Journal. This half-day seminar focused on current real estate trends for retail, industrial, office and multi-family property types in the Minneapolis/St. Paul market.

Mike Roessle, Market Economist with CoStar provided a short overview of the United States and local economic overview. These are the pertinent items identified.

- Lower skilled jobs are never coming back to US.

- Minneapolis/St. Paul growth in the 65+ age group is expected to exceed the U.S. average and soon outpace under 18 age group. This will lead to a pear-shaped demographic chart.

- International migration has helped to provide positive population growth in the Twin Cities. Most of the migrant population provides low or highly skilled labor talent.

- U.S. economic growth is slowing, but not plunging.

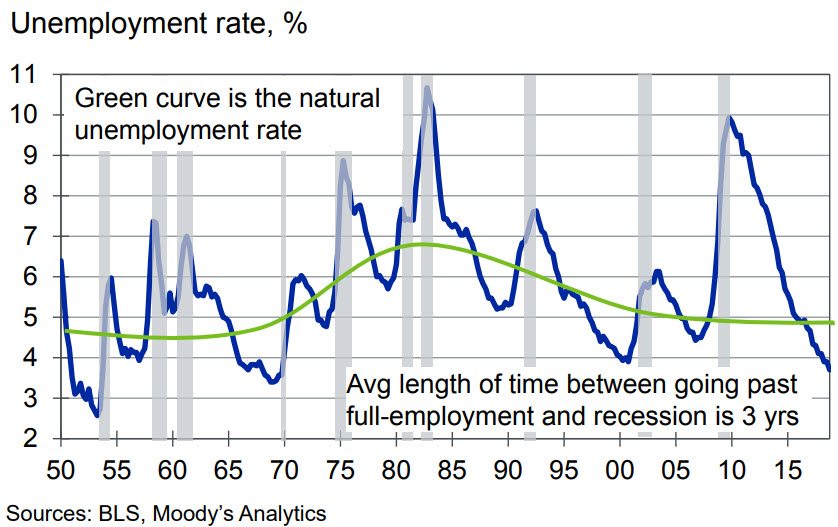

- It was mentioned the average length of time between surpassing full-employment and the next recession is three years. As the following chart shows, the U.S. economy appears to have surpassed full-time unemployment about three years ago.

- In 2019, the U.S. 10-year yield has dipped below the 3-month yield. This results in an Inverted yield curve – meaning an interest rate environment in which long-term debt instruments have a lower yield than short-term debt instruments of the same credit quality. This has historically preceded recessions.

Retail Update: Opportunities and Trends – State of the Market

Moderator: Lisa L. Diehl, Principal, Diehl and Partners, LLC.

Deb Carlson, Director Brokerage Services, Cushman & Wakefield

Margaret Linvill Smith, President, Linvill Properties

Mark Robinson, Principal Investment Sales, Mid-America Real Estate

J. Lindsay, President, The Lindsay Group

Retail

- The new buzz word from ICSC in Las Vegas this year was “Retail Renaissance.” In my mind, that’s far more uplifting than the media derived “doom and gloom” drumbeat of Retail Apocalypse. There are still plenty of opportunities in retail.

- Low unemployment rate is impacting retailers and making it difficult to fill jobs and hinders growth. On the positive side, companies are looking at ways to innovate and implement technology where possible to offset labor shortages.

- On the national retail scene, many store closures in 2018 were bankruptcy related. Going forward, expect to see more frequent strategic store closures due to poor performance.

- For the Twin Cities retail market, the number of national bankruptcies in 2018 impacted big box space across the metro. While location always impacts real estate decisions, the mantra of how the retail market is faring today is “It Depends.” Importance of location is very prevalent in backfilling the vacant spaces. Class A-type locations are faring well, and Class B-type locations are taking longer to lease-up and dealing with more competition.

- Many Class B and C centers have flat to declining rental rates to attract tenants.

- Internet resistant and e-commerce stores moving into bricks and mortar are growth areas. As the market continues to shift, the truth is no one truly knows what defines internet resistant. Ex. grocery stores have more competition from shipping and delivery options.

- General outlook is to expect more of the same for now.

- Local developers including Margaret Linvill Smith, Linvill Properties and J Lindsay, The Lindsay Group talked about really striving to create unique experiences at their neighborhood centers. It’s also important to spend time thinking about how the landlord can best help the tenants.

- When backfilling vacant spaces, need to be creative and relational with tenants

- Investment Sales Trends (from Mark

Robinson, Mid-America Real Estate)

- Single tenant and higher quality strip retail still seeing strong demand, but waning

- Liquidity and debt availability is still strong, but need to shop more to find the right lender.

- Estimated at least half of investment sales are 1031 buyers.

- Legacy retailers and restaurants are tougher to sell.

- Buyer-seller expectation gap widening

- One idea on how to repurpose B and C big box centers. Remodel/narrow the depth of buildings and sell outlots along street frontage if land value is high enough.

- In MN, a real factor is operating expense costs have risen, what used to be $6.00/ are now $10.00/SF+. Other states, such as Florida, operating expenses are still slower. This has a real impact on ability of retailers to afford new locations and makes them pause and slow growth.

- Technology – Artificial Intelligence is increasing in shopping centers with ability to track where shoppers have been. Based on the feedback from the panel, I’m not the only one who thinks this is CREEPY!

Industrial

Real Estate Update – State of the Market

Moderator:

James DePietro, Senior

Vice President, CBRE

Tom

Bennett, First Vice

President, CBRE

Peter

Mork, Founding Partner,

Capital Partners

Paul

Hyde, CEO, Hyde Development

Steve

Hoyt, CEO, Hoyt Properties

Industrial

- While not prevalent int the Minneapolis/St. Paul market yet, vertical industrial logistics is coming -think multi-story. Especially, to help with one-two hour deliveries and last-mile distribution. This makes infill sites very desirable, but its difficult to find good large tracts.

- Average age of refrigerated spaces in US is 34 years – new space is coming.

- There is a shortage of cold storage. The challenge is new construction costs are $125-$150/SF so difficult to build speculative space. This link provides good insight on cold storage trends and needs: https://www.cbre.us/research-and-reports/US-Food-in-Demand-Series-Cold-Storage-Logistics-Unpacked-May-2019

- According to one broker, the secret sauce to Amazon’s success is the advanced level of technology in their buildings and increased automation.

- The Twin Cities industrial market continues to see strong demand and 35 quarters of positive absorption.

- Additional new industrial speculative space will be needed with bulk warehouse the main drive because of investor demand.

- Flex warehouse space is in high demand but seeing limited new development. Flex office deals are attractive to tenants because of lower rents. Attractive to landlords because of lower TIs and easier to backfill after rollover.

- Two things drive industrial development – jobs and capital. Lending has been very disciplined over the last 10 years which is good.

- As with most real estate sectors, companies are having a hard time to vacant positions.

- A few recent transactions point to high-water benchmarks for industrial. There was a recent $12.37/SF Roseville land sale and the Industrial Equities/John Allen 34 building, 2.5 million SF, $227 million all cash portfolio sale to Blackstone that traded at a 5.5% cap rate. It makes me ponder -is this a positive sign showing continued bullish strength of the market or is the market getting out of line?

- Strong investment demand including foreign capital looking to secondary markets after getting priced out of primary and coastal markets.

- Cap Rate Compression -How low can they go?

- Construction Costs – $70.00/SF is the new $40.00

- New construction rents – new norm is $11.75/$5.75/SF – replaces the $8.00/$4.00

- Seeing annual construction cost increases of 8-12%.

- Seeing more 7-to-10-year leases to help offset higher construction costs and lease rates.

- 2.5% annual rent increases are typical right now.

- Buildings are getting bigger and higher.

2019 Minneapolis Industrial Predictions (from CBRE slide deck)

- Continued emergence of private capital investors for offerings under $20 Million

- All-time high pricing continues

- Infill locations will become more valuable regardless of functionality

- Continued positive absorption

- Value appreciations for light industrial and tech

- E-Commerce emergence still in early innings

Office Market

Update – State of the Market

Moderator:

Julie Kimble, President,

KimbleCo

Steve Chirhart,

Principal, TaTonka Real Estate Advisors

Brent

Erickson, Senior Managing

Director, Newmark Knight Frank

Jim

Montez, Vice President,

Transwestern

Andrew

Webb, Managing Principal,

Redline Property Partners

Office

- Stabilized assets are selling in CBD -Class A trophy buildings represented the most investment sales in 2018; holding top of market rents and consistent occupancy attracting buyers from large investment groups

- Parking in the CBD’s still an issue.

- The push to urban has hurt every suburban market except the I-394 corridor

- Creative office buildings saw high investment activity (national trend) in 2018 especially urban and NE Minneapolis

- Mega projects help impact a small submarket. Ex. Allianz Field project in Midway St. Paul which Cushman and Wakefield is working on to market a mixed-use development.. The office component is normally a smaller piece of the larger mixed-use redevelopment.

- A more mature example of this would be the significant North Loop development around Target Field since 2010.

- Outward urbanization from downtowns.

- Most prospects for Dayton Project have been from outside markets than MN.

- Interesting that many of the mega projects are in East Metro.

- Construction costs continues to climb. Important to clarify with tenants upfront about construction bid expectations.

- New TIs and Renewal TIs both continue to climb

- Up to $70-$80 for new TIs.

- If looking to shed excess office space, need to really discount.

- Co-working space trend continues. Flexibility of floor plates and more space being allocated for common area spaces and amenities is happening.

- According to one office building investor, 10%-20% feels like a good percentage of coworking space in a multi-tenant building.

- About 5% used to be provided for common area, moving closer to 10%. Working to create more experiential office opportunities. Amenities are very important for employers to provide to employees and good enough they will actually be used.

- Coworking makes it easier for companies to jump into a space with limited time spent on planning, etc. Working to create “communities” in the coworking space.

- One panel member expects a bubble in coworking space in next 24 months, especially if a correction occurs in the economy.

- Flight to Quality, with Class A and top Class B buildings

- Natural lighting in buildings has improved.

- More layers of different space needs within a suite are important questions to answer in terms of what tenants want and need.

- Institutional money is now more aware of Minneapolis market. Investors want cool buildings like tenants. Events like the Super Bowl, Final Four and PGA golf tournament have all helped put Minneapolis on world map.

Apartment

Market Overview – State of the Market

Moderator:

Abe Appert, Executive

Vice President, CBRE

Ted

Bickel, Senior Vice

President, Colliers International

Anne

Olson, COO, IRET

Matt

Mullins, Vice President,

Maxfield Research & Consulting, LLC

Apartments

As more supply enters the market which impacts apartment rent growth, operators are working on ways to implement Ratio Utility Billing System (RUBS) and increase other income.

In the Twin Cities, capitalization rates for Class A apartments are 4.5% to 5%. Low to mid 5% range for Class B cap rates and Class C cap rates are around 6.0%.

Minneapolis/St. Paul metro area has 4x the historical sales volume in the current cycle. The amount of new construction in recent years has changed the historical buy and hold long-term strategy of local owners. There is more merchant capital and developers that build and sell.

According to data from CBRE, over the past few years, 41 of 54 transactions (76%) of 100+ units were out of market buyers. The Twin Cities are widely accepted as a good market to invest in for apartments.

I’ve heard of Airbnb, but this was the first time hearing about short term rental companies Stay Alfred and Pillow. At least one developer is looking to construct a new apartment building for Stay Alfred and sign a master lease to them.

While few data points exist so far, the panel opined a slight uptick in cap rates is anticipated on projects with a higher percentage of units rented to short term rental stay companies.

Micro units and co living spaces are present. Amenities are incredibly important for these space types. More about being able to offer an affordable monthly rent vs. $/SF. These projects require a very site specific, niche product.

Conference rooms and video conferencing are becoming more important in apartment buildings as more people work remotely.

With micro units, some have seen some operational challenges such as payroll. Also, expect to see more turnover with these units.

It’s becoming more difficult to justify new development due to construction costs.

Modular multi-family construction is being talked about but hasn’t really gained traction yet. While modular construction can offer lower costs, building codes in Minnesota result in higher costs. One challenge is how far the construction plant is from the development site. Greater distances increase transportation costs.

Mitchell Simonson, MAI has been in commercial real estate for 15 years and founded Simonson Appraisals on January 1, 2019. Mr. Simonson enjoys writing about and discussing commercial real estate, personal development and business. Do you have questions on these topics? Contact him today!