Over the past 12 months, I have appraised numerous outstate Minnesota apartments ranging in size from about 20 to 150 units. The geographic region has spanned the “banana belt” surrounding the Minneapolis/St. Paul metropolitan area. The primary cities forming the “banana belt” include Rochester, Mankato, St. Cloud and Duluth. This allows us to complete in-depth analysis of historical income and expense statements on assignments completed throughout the year. Additionally, our firm supplements the internal observations and data by constantly interviewing apartment owners, brokers, property managers and lenders.

This article discusses general rent, vacancy, operating expense, and capitalization rate trends in outstate Minnesota. A quick overview of each is summarized below, followed by more details.

Rents – Generally speaking, rents remained strong in 2016 with most communities able to increase rents. The exception is Fargo/Moorhead where rents are flat as supply exceeds current demand.

Vacancy Trends – Vacancy rates in communities such as St. Cloud, Mankato, Rochester, county seats and smaller communities remained quite low. Fargo/Moorhead is experiencing significant over supply and vacancies have climbed to 9.2%.

Operating Expenses – Operating expenses in outstate Minnesota have held pretty stable. With rising sale prices, real estate taxes continue to be a concern for property owners.

Cap Rates – Cap rate compression was prevalent in 2016 and more noticeable in the larger metro areas such as St. Cloud, Rochester, and Mankato. More buyers extended out from the Minneapolis/St. Paul metropolitan in search of investment opportunities with higher yields.

Rent Trends – The quick story here is rents continued their upward ascent that has now been in place for several years in the outstate MN apartment market. Overall, low vacancies and steady renter demand allowed owners and managers to implement one or more rent increases. A few participants reported rent growth of 5% to 8%. However, not all properties are operated and managed the same and some owners tend to be more conservative with regard to rent growth.

It seems the one notable exception is the Fargo/Moorhead metropolitan area. As the physical vacancy rate approaches 10%, rents have held flat for the last 18 months and new apartments coming online are offering rent concessions to lease-up (Appraisal Services, Inc.). Another market to keep an eye on over the next 12 to 18 months is the St. Cloud metropolitan area as multiple projects are under construction. At present, the St. Cloud market remains healthy with rent growth reported across all apartment classes.

By and large, rent increases occurred in 2016 across smaller communities such as county seats. This is attributable to fewer new units being added in these areas as rents are lower and make it more difficult to justify new construction. Some participants opined rent increases may slow some in 2017.

Vacancy Trends – In 2016, it seemed every outstate community surveyed with the exception of Fargo/Moorhead had stabilized vacancy rates (less than 5%). There was some thought one year ago that vacancies may rise slightly in 2016. However, based on the data, this did not appear to be the case.

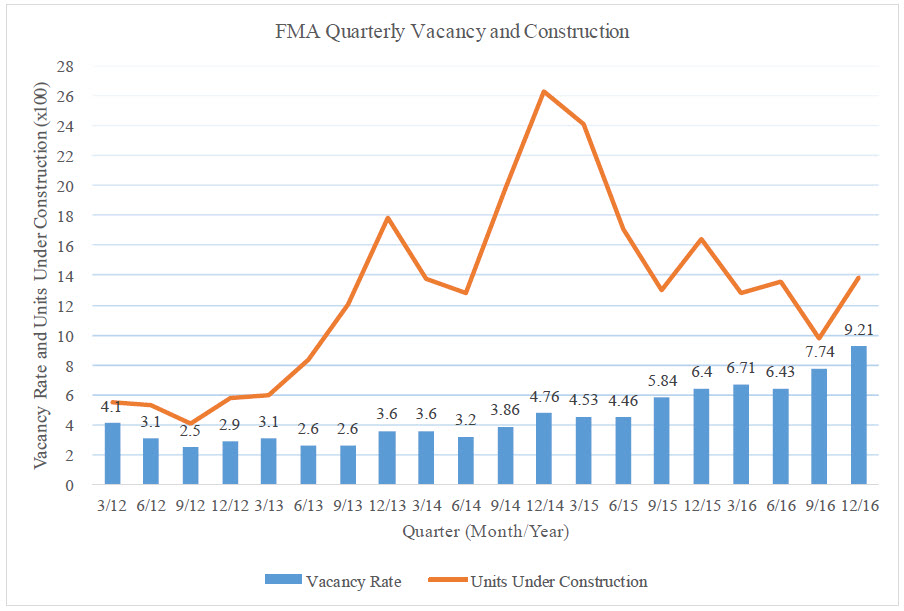

According to data compiled by Fargo appraisal firm Appraisal Services Inc., the current vacancy rate in Fargo-Moorhead metropolitan area is 9.21%. This represents a substantial increase from 6.4% one year ago. The following table shows the quarterly vacancy rate and number of units under construction in the Fargo-Moorhead metropolitan area over the past five years.

Source: Appraisal Services Inc

Over 6,000 units have been added to the Fargo market area since 2012 when vacancy rates were at the floor of 2.5% metro wide. Across Minnesota, a healthy economy, steady tenant demand and reasonable pace of construction have resulted in minimal vacancy risk. Most participants do not anticipate significant changes in vacancy in 2017.

Operating Expenses – Real estate taxes are generally cited as the one major area of concern. As values have increased over the past few years and sales become available, this tends to be the one consistent expense line item that is of concern to investors. Utility expenses tend to increase annually. A review of historical operating expenses for most properties suggests relatively stable expenses for other line items. With low vacancies in most markets and steady rent increases, operating expense ratios have stayed flat or decreased. Rising labor and maintenance costs have reportedly been a concern in Minneapolis/St. Paul metro area properties, but not so much in outstate areas.

Capitalization Rates

Capitalization rates continued to compress across outstate Minnesota in 2016. It was evident more buyers were searching for investment opportunities beyond the Minneapolis/St. Paul metro area. Based on actual data points and multiple conversations with owners and brokers, cap rates compressed approximately 20 to 50 basis points. One good example is the St. Cloud metropolitan area. For many years, buildings with 12 to less than 50 units and constructed in the 1970s and 1980s seemed to sell for about $45,000 per unit and traded with cap rates in the 7.75% to 8.25% range. Last year, the compression resulted in cap rates closer to 7.5% and higher per unit sale prices.

Higher quality apartments in the larger communities (such as Fargo, Mankato, St. Cloud, etc.) are in the approximate range of 6.25% to 7.00%. Rochester and St. Cloud saw a few larger, newer properties trade with cap rates below 6.0%. Cap rates for average-to-good quality properties in smaller communities trended lower, and generally range from about 6.75% to 7.75%. Properties with some level of deferred maintenance and/or older properties tend to sell at cap rates of 8.00% and above. Of course, each property is unique and must be analyzed independent of the general market parameters.

Most market participants report general optimism for continued strength in the outstate apartment market, particularly with a stable tenant base.

What are your expectations for outstate MN apartment activity in 2017?

Are you looking for information on valuation trends in Minneapolis/St. Paul metro area? This link can help you: Minneapolis/St. Paul – 2017 Commercial Real Estate Trends and Expectations

Mitchell Simonson, MAI is an expert commercial real estate appraiser and investor. If you have a market related question, please feel free to call at 612-618-3726 or email mitch@simonsonap.com.