Photo taken of recent new construction in Detroit Lake, MN by Mitchell Simonson, MAI

Outstate MN – 2016 Apartment Trends & Expectations

In the past 12 to 24 months, I have appraised numerous outstate Minnesota apartments ranging in size from about 20 to 100 units. The geographic region has spanned the “banana belt” surrounding the Minneapolis/St. Paul metropolitan area. The primary cities forming the “banana belt” include Rochester, Mankato, St. Cloud and Duluth. In 2015, our firm appraised fewer outstate apartment buildings as compared to 2014. To supplement our internal observations and data, I interviewed several apartment owners and brokers.

This article discusses general rent, vacancy, operating expense and capitalization rate trends. A quick overview of each is summarized below, followed by more details.

Rents – Fewer rent increases reported in some of the larger communities such as Fargo and St. Cloud, with some concessions appearing. Slight rent increases continue in smaller communities such as county seats in outstate Minnesota.

Vacancy Trends – With varying levels of multi-family construction appearing in the outstate metropolitan/micropolitan areas, vacancies have inched upward and some concessions are now prevalent.

Operating Expenses – Real estate taxes are generally cited as the one major area of concern.

Cap Rates – According to one very active buyer in Outstate Minnesota, cap rates declined approximately 10 to 25 basis points in 2015 for newer product. Cap rates for older product have trended slightly lower as well.

Rent Trends – For several years leading into 2015, the outstate MN apartment market experienced increasing rents as supply was very tight and demand was increasing. In 2015, rents began to level off in some of the larger communities such as Fargo and St. Cloud, with some concessions appearing. However, not all properties are operated and managed the same. Several owners still report very favorable market conditions and confirmed rents were raised again in early 2016.

A few owners project slight rent increases in 2016 in some smaller communities such as county seats across outstate Minnesota. This is partly attributable to fewer new units being added in these areas over the past few years.

Vacancy Trends – With varying levels of multi-family construction appearing in the outstate metropolitan/micropolitan areas, vacancies have inched upward and concessions are now prevalent in some markets. This is not true across every property and market, but appears to be the case in the larger cities such as St. Cloud, Fargo, etc.

According to data compiled by Fargo appraisal firm Appraisal Services Inc., the current vacancy rate in the City of Fargo is 5.3%. This is an increase from 4.3% one year ago. The vacancy rate in the greater Fargo metropolitan area increased from 4.7% to 6.4% over the past 12 months. The total number of surveyed units in December 2015 was 29,196 units, compared to 25,699 in December 2014. Approximately 2,568 new multi-family units came online in the Fargo-Moorhead metro market in 2015. Despite the vacancy increase, market absorption of new units added was still quite strong and this is attributable to continued population growth. Current construction is down significantly from this time last year.

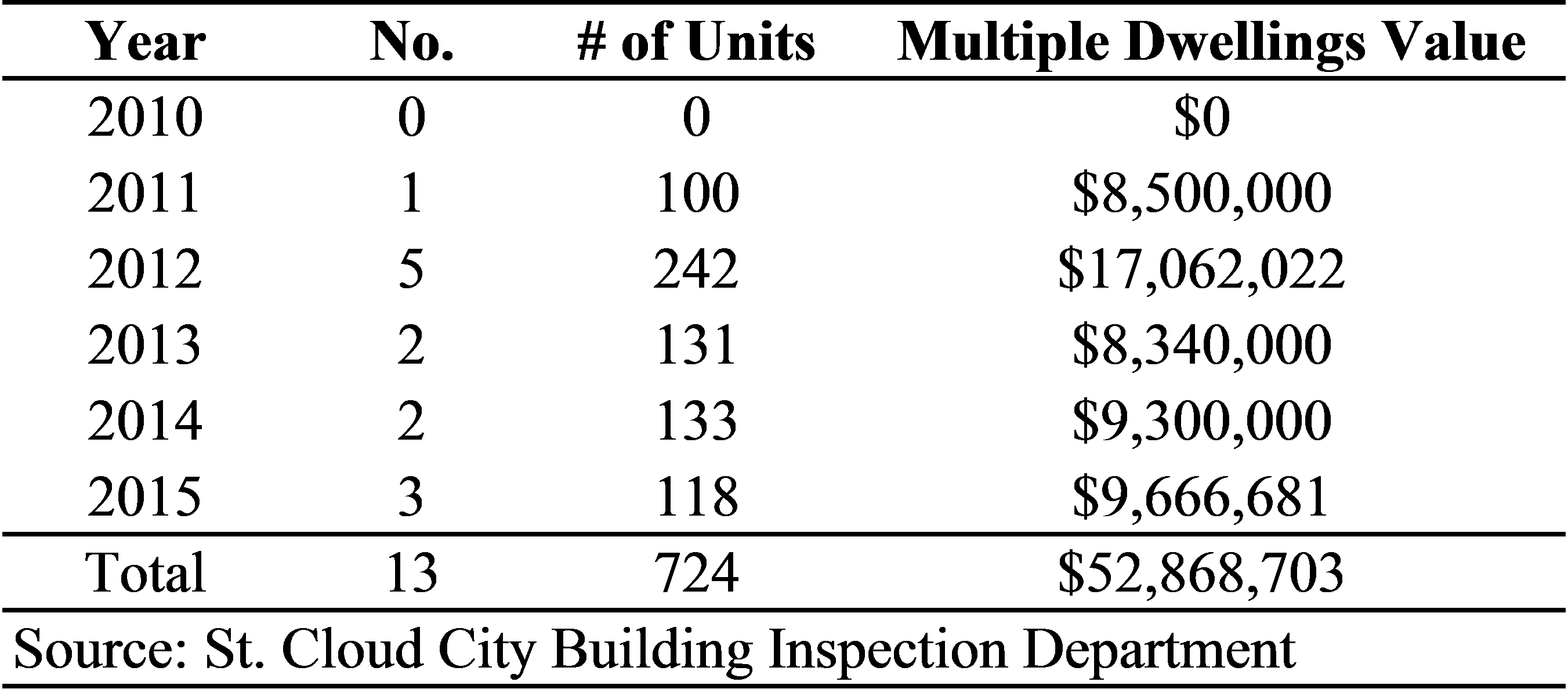

To gauge the impact of new construction on overall supply in another outstate market, I looked at recent construction trends in St. Cloud. According to the St. Cloud City Building Inspection Department, 724 new apartment units within 13 buildings have been delivered to the market since 2010. This count would not include any units added in the surrounding communities such as Sartell, St. Joseph, Sauk Rapids, etc.

St. Cloud has approximately 14,487 total rental units including single family homes. With 724 new apartment units constructed since 2010, this represents an approximate 5.00% increase to the overall rental unit supply in St. Cloud.

Operating Expenses – Real estate taxes are generally cited as the one major area of concern. As values have increased over the past few years and sales become available, this tends to be the one consistent expense line item that is of concern to investors. Utility expenses tend to increase annually. A review of historical operating expenses for most properties suggests relatively stable expenses for most other line items. One property manager reported more cities tend to be more quickly applying clean-up fees for excess garbage and other miscellaneous items without warning.

Cap Rates/Investment Sale Trends

According to one very active buyer in Outstate Minnesota, cap rates declined approximately 10 to 25 basis points in 2015 for newer product. Higher quality apartments in the larger communities (such as Fargo, Mankato, St. Cloud, etc.) are in the approximate range of 6.50% to 7.00%. Cap rates for average-to-good quality properties in smaller communities trended slightly lower, and generally range from about 7.00% to 7.75%. Properties with some level of deferred maintenance and/or older properties tend to sell at cap rates of 8.00% and above.

Several participants stated the availability of properties coming to market in 2015 was limited, which resulted in fewer transactions despite a healthy appetite for additional purchases. The consensus is more properties will be listed for sale in 2016. Most property owners and managers report general optimism for continued strength in the outstate apartment market, particularly with a stable tenant base.

What are your expectations for outstate MN apartment activity in 2016?

Mitchell Simonson, MAI is an expert commercial real estate appraiser and investor. For any real estate related questions or comments, please call 612-618-3726 or email to mitch@simonsonap.com.